I hope many of you will consider creating a budget and that you find these steps easy to complete. At any time you have questions or need assistance, please feel free to contact me at saydeepojas@gmail.com.

Today's topic will get you started on tracking your spending and begin evaluating how you've been handling your money.

Step 1: Track Your Spending (PART I)

Everyone has a limited amount of money available to spend. To be able to manage this money is important for financial success. There are different types of expenses to track Fixed, Fixed-Variable, and Variable.

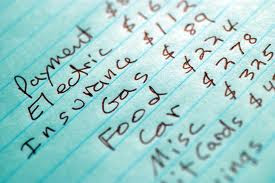

1. Fixed Expenses - Start a list of the bills and their amounts that you pay the same exact amount every month. These expenses include but are not limited to the following:

1. Fixed Expenses - Start a list of the bills and their amounts that you pay the same exact amount every month. These expenses include but are not limited to the following: Rent/Mortgage

Car Payment

Insurance (Auto, Home, Life, etc)

Credit Card

In addition, add to this list the bills that you pay on an Annual basis (or every 6 months). Divide the amount you owe by 12 to split the amounts evenly over the year. These fixed annual expense include but are not limited to the following:

Car Registration

Gym Membership

2. Fixed-Variable Expenses - The next bills to track are bills that you pay monthly, but the amounts vary from month to month. To figure out the amount, look at the amounts you've paid for these bills over the past 3-6 months and write down the average amount that you paid. These fixed-variable expenses include but are not limited to the following:

Cell Phone

Electric

Water

Credit Card (if you minimum monthly payments vary month to month)

You can hand write these amounts, but I find using an excel spreadsheet is easiest because it will do the calculations for you. Below is an example of what your spreadsheet may look like after tracking these two types of expenses.

Next Blog Topic: Step 2: Track Your Spending (PART II)

No comments:

Post a Comment